Limited Liability Partnership (LLP) is a popular business structure in India that offers the benefits of both a partnership and a limited liability company. It is an ideal choice for small and medium-sized businesses that want to enjoy the flexibility of a partnership while limiting their liability.

In this blog, we will discuss how to apply for LLP registration online in India and the common mistakes that you should avoid.

What Is LLP Registration?

LLP registration is the process of registering a limited liability partnership with the Registrar of Companies (ROC) in India. The LLP Act, 2008, governs the registration of LLPs in India. An LLP is a separate legal entity from its partners and has a perpetual succession. LLP registration is mandatory for businesses that want to operate as an LLP in India.

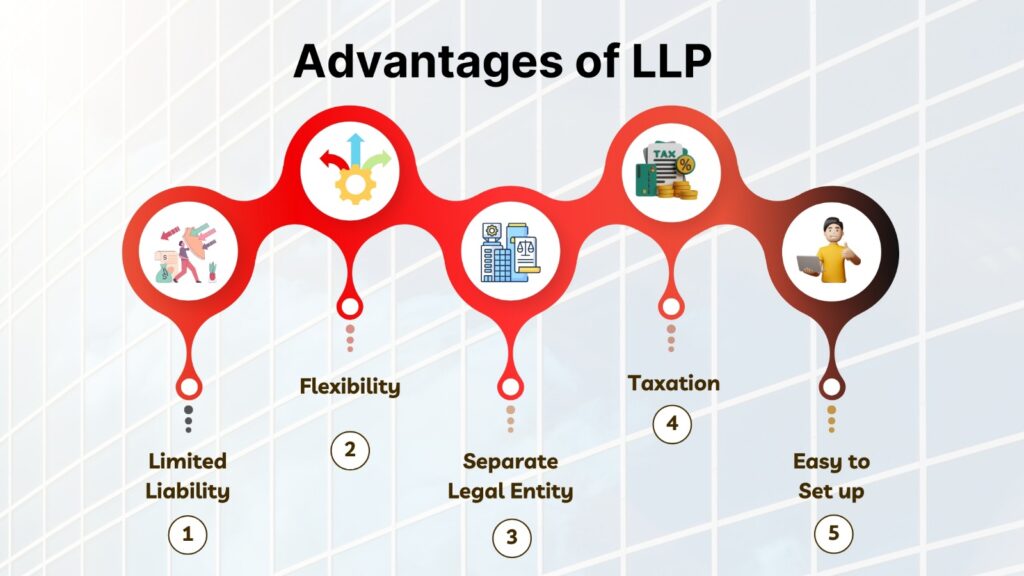

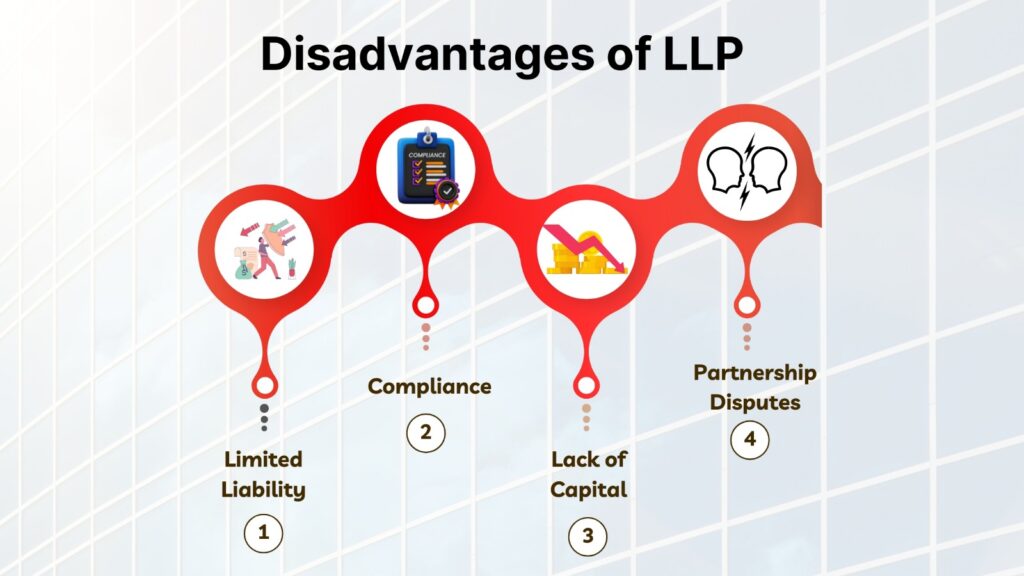

Before talking about the steps to apply for LLP registration online, let’s first discuss the advantages and disadvantages of LLP.

In this section, we will explore the advantages and disadvantages of LLP in detail, including its limited liability protection, flexibility in management, taxation, compliance requirements, and potential drawbacks such as partnership disputes and lack of capital raising options. Understanding the pros and cons of LLP can help you make an informed decision on whether it is the right business structure for your needs.

Feature of LLP Registration

- It has a separate legal existence.

- A Minimum two individuals are required to be partners to establish an LLP.

- There can be any number of partners, no limit is practiced.

- It is essential for one of the two minimum partners to be a citizen of India.

- The liability each partner is liable to is equal to their contribution.

- Forming an LLP is less expensive than other business structures.

- Easier compliance to follow.

- No requirement of minimum capital contribution.

Advantages of LLP:

- Limited Liability: One of the biggest advantages of an LLP is that it offers limited liability protection to its partners. This means that the personal assets of the partners are protected from any legal or financial obligations of the LLP.

- Flexibility: LLP provides flexibility in terms of its management and ownership structure. Partners have the freedom to manage the LLP as per their requirements and are not bound by strict rules and regulations.

- Separate Legal Entity: LLP is a separate legal entity from its partners, which means that it can own assets, enter into contracts, and sue or be sued in its own name.

- Taxation: LLP is taxed as a partnership, which means that it is not subject to corporate tax. The profits and losses of the LLP are passed through to the partners, who are taxed at their individual tax rates.

- Easy to Set up: LLP registration process is simple and easy, and it can be done online.

Disadvantages of LLP:

- Limited Liability: While limited liability is an advantage, it can also be a disadvantage. The limited liability protection may be lost if a partner personally guarantees a loan or debt.

- Compliance: LLPs are required to comply with various regulations, such as annual filings, audits, and tax filings. Non-compliance can result in penalties and fines.

- Lack of Capital: LLPs cannot raise funds from the public through the issue of shares, which can limit their ability to raise capital.

- Partnership Disputes: LLPs are run by partners, and disputes between partners can lead to disruptions in the business.

Checklist for LLP Registration

- Minimum of two partners.

- DSC for all designated partners.

- DPIN for all designated partners.

- Name of the LLP, which is not similar to any existing LLP or trademark.

- Capital contribution by the partners of the LLP.

- LLP Agreement between the partners.

- Proof of registered office of the LLP.

To ease up this process and for help, checkout our services at TheStartupLab, where we help our clients through each crucial step of company registration.

What are the basic requirements of LLP?

To register an LLP in India, certain requirements need to be fulfilled. Here are the LLP registration requirements:

1. Minimum Partners: LLP must have a minimum of two partners. There is no limit on the maximum number of partners.

2. Designated Partners: LLP must have at least two designated partners, who are responsible for the management of the LLP. One of the designated partners must be a resident of India.

3. Digital Signature Certificate (DSC): DSC is mandatory for all designated partners of the LLP. DSC is used to sign the LLP registration application and other documents related to the LLP.

4. Director Identification Number (DIN): All designated partners must obtain a DIN from the Ministry of Corporate Affairs (MCA). DIN is a unique identification number that is assigned to each partner.

5. Name Reservation: Before filing the LLP registration application, you need to reserve a unique name for the LLP. The name should not be similar to any other LLP or company name.

6. Registered Office Address: LLP must have a registered office address in India. The address can be a residential or commercial address.

7. LLP Agreement: LLP agreement is a legal document that outlines the rights and obligations of the partners and the management structure of the LLP. It must be filed with the LLP registration application.

8. Documents: You need to submit identity proof, address proof, and PAN card of all designated partners, along with proof of registered office address.

9. Fees: You need to pay the required fees for LLP registration, which can be done online through the MCA portal.

In conclusion, to register an LLP in India, you need to fulfil certain requirements, such as having a minimum of two partners, obtaining a DIN and DSC for designated partners, reserving a unique name, having a registered office address, filing the LLP agreement, submitting the required documents, and paying the fees. It is important to follow the LLP registration requirements carefully to ensure a smooth and successful registration process.

What is the process for LLP registration?

Applying for LLP registration online in India is a simple process. Here are the steps to apply for LLP registration online:

Step 1: Obtain Digital Signature Certificate (DSC): The first step in the LLP registration process is to obtain a Digital Signature Certificate (DSC) for the designated partners. A DSC is an electronic signature that is used to sign the LLP registration application. You can obtain a DSC from any of the certifying authorities recognized by the Ministry of Corporate Affairs (MCA).

Step 2: Obtain Director Identification Number (DIN): The next step is to obtain a Director Identification Number (DIN) for the designated partners. A DIN is a unique identification number that is assigned to each partner of the LLP. You can obtain a DIN by submitting an application on the MCA portal.

Step 3: Reserve a Name for the LLP: Before filing the LLP registration application, you need to reserve a unique name for the LLP. The name should not be similar to any other LLP or company name. You can check the availability of the name on the MCA portal and reserve the name by filing Form LLP-RUN.

Step 4: File the LLP Registration Application: After obtaining the DSC, DIN, and name reservation, you can file the LLP registration application on the MCA portal. You need to fill the Form LLP-1, which is the application for incorporation of an LLP. Also, you need to attach the required documents, such as the LLP agreement, proof of registered office address, and identity and address proof of partners.

Step 5: Payment of Fees: After filling out the LLP registration application, you need to pay the required fees. The fees can be paid online through the MCA portal.

Step 6: Verification of Application: After the payment of fees, the LLP registration application is verified by the Registrar of Companies (ROC). The ROC may ask for additional information or documents if required.

Step 7: Issuance of Certificate of Incorporation: Once the LLP registration application is approved, the Registrar of Companies issues the Certificate of Incorporation. The Certificate of Incorporation is proof of the LLP’s existence and contains the LLP’s name, registration number, and date of incorporation.

Cost Involved in LLP Registration

An LLP registration is less expensive than other business structures, however, there is still considerable cost involved, let’s discuss:

In a Limited Liability Partnership, the registration cost depends on the capital invested in it. The fee slabs are as follows:

- If the capital contribution is less than ₹ 1 lakh, the fee is ₹ 500/-.

- If the capital contribution is between ₹ 1 lakh and ₹ 5 lakhs, the fee is ₹ 2000/-.

- If the capital contribution is between ₹ 5 lakhs and ₹ 10 lakhs, the fee is ₹ 4000/-.

- If the capital contribution is more than ₹ 10 lakhs, the fee is ₹ 5000/-.

LLP incorporation takes roughly 10 days, subject to official approval and response from the competent department, between acquiring DSC to filing Form 3.

Other Costs Involved in LLP Registration

The name of LLP can be reserved for 90 days, after which it becomes invalid. Both designated partners need to pay for digital signatures, which vary depending on the agency that issues them Form fees for Registration LLP agreement drafting fee DIN form fees stamp duty for the LLP agreement execution, which differs from state to state.

Summary

To summarize, LLP registration in India involves fulfilling certain requirements such as having a minimum of two partners, obtaining a DIN and DSC for designated partners, reserving a unique name, having a registered office address, filing the LLP agreement, submitting the required documents, and paying the fees.

The LLP registration process can be completed online through the MCA portal and involves obtaining DSC and DIN, reserving a unique name, preparing an LLP agreement, filling out an LLP registration application, submitting documents, paying fees, and approval of LLP registration by the ROC. Understanding the LLP registration requirements and process can help you successfully register your LLP in India.

[Read: Difference Between LLP And Private Limited Company In India]

If you are planning to register an LLP in India, The StartupLab can help you simplify the process and avoid common mistakes. Our team of experts can assist you with the LLP registration process from start to finish, ensuring a smooth and successful registration process.

With TheStartupLab, you can save time, reduce stress, and focus on growing your business. Contact us today to learn more about our LLP registration services and get started on your entrepreneurial journey.

Follow us and connect with us on Instagram, Facebook, Twitter, and LinkedIn.

Note: If you are a budding entrepreneur and require assistance Register a Company, Startup Funding, Financial Projections, Business Valuation Services, LLP Registration, Compliance Services, Shareholders Agreement, funding formalities, Debt Funding, CFO Services, or other startup-related Legal Services, Contact Us.

FAQ

Q. What is an LLP?

Limited Liability Partnership is a business structure that combines the benefits of both partnership and company structures, offering limited liability to its partners.

Q. What are the advantages of registering an LLP?

Ans. Registering an LLP provides the partners limited liability protection and flexibility in management.

Q. How many partners are required to form an LLP?

Ans. A minimum of two partners are required to form an LLP.

Q. What is the process for registering an LLP?

Ans. The steps include obtaining a Digital Signature Certificate (DSC), applying for a Director Identification Number (DIN), reserving the LLP name and filing the incorporation form.

Q. Is there a minimum capital requirement for LLP registration?

Ans. No minimum capital is required for registering an LLP.

Q. Can a foreign national be a partner in an LLP?

Ans. Yes, foreign nationals can be partners in an LLP, as long as there is compliance with FEMA regulations.

Q. What documents are required for LLP registration?

Ans. To register as an LLP, the partner’s documents are required such as ID proof, address proof and the proof of address of the office.

Q. How long does it take to register an LLP?

Ans. The registration process usually takes 15-20 working days, depending on the promptness of document submission and approvals.

Q. What compliances does an LLP need to follow?

Ans. All LLPs have to comply with all regulatory filings and file annual and financial statements.