Business Valuation Services | Company Valuation Services in India

Running a successful company involves mastery of many aspects of the business. Not only does your company need to do well, but every successful CEO knows every vital detail about their business. They know its strengths and weaknesses to the core. One such important detail is the business value. We call this business valuation. It is a high-note detail that is impacted by a multitude of factors. At The StartupLabs, we are here to take care of all these factors and provide our extensive expertise to assist you with our business valuation services, which would give you valuable insights necessary to drive growth by knowing the true value of your esteemed business.

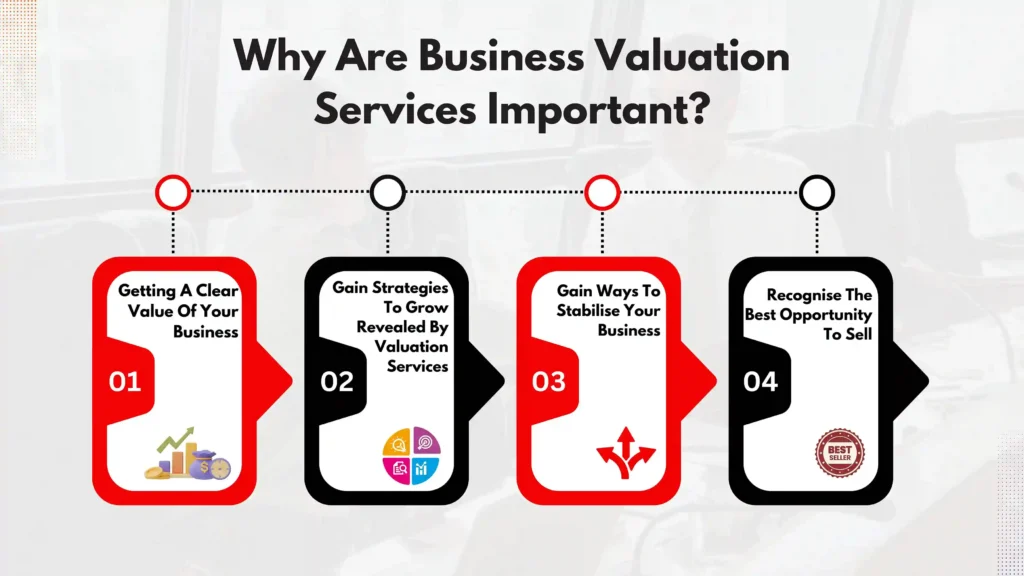

Why Are Business Valuation Services Important?

To get an accurate valuation of your business, you can trust and make critical decisions on the future of your business; it is vital to leave it to professionals who have specialised their careers in this field. By hiring a proven and competent team of valuation services consultants, you can use their well-earned technical knowledge and training to get the most accurate value for your business. Let’s explore different beneficial reasons to hire valuation services and why valuation is vital for your business.

Getting A Clear Value Of Your Business

With a proper business valuation, you can get an accurate, comprehensive, and fair value for your business. A good business valuation service uses the latest techniques and notes all the key factors that affect its value, giving you clear and honest insights.

Gain Strategies To Grow Revealed By Valuation Services

Business valuation services not only reveal the value of your business but also key data that you may use to create strategies that grow your business. By shedding light on factors that were not paid attention to before, they help you take advantage of and boost your business in that key area.

Gain Ways To Stabilise Your Business

If you seek business stability, hiring business valuation services is beneficial. Through the service, you can get an accurate assessment of your business’s stability and whether it is on the right, growthful track. If not, you can use the data and insights provided by business valuation consultants to bring your business back on the right track.

Recognise The Best Opportunity To Sell

With an accurate business value, you can recognise the best opportunity to sell your business to an interested party. Valuation services provide ample data to strategise the optimal selling operation and lure many potential buyers so that you can make the best possible choice for your future.

How The StartupLab Will Help You in Business Valuation?

At The StartupLab, we grasp the significance of having a fair and accurate value for your business. It can help you cultivate ideas and design strategies that take your business to the next level. You cannot go to step two before going through step one, and knowing the value of your business is a fundamental step that you must take. As such, we at The StartupLab are here to help you in this venture through our valuation services.

In our services, we provide three specialised business valuation methods:

- DCF Analysis (Discounted Cash Flow)

- Precedent Transactions Analysis

- Comparable Company Analysis

Let’s discuss them one by one so that you have a clear idea of our highly effective business valuation services:

DCF Analysis (Discounted Cash Flow)

We use the discounted cash flow analysis method to estimate the value of an investment using its expected future cash flows and analyse the value of your business today based on future projections of how much money it could generate in time. DCF can help you as a business owner devise capital budgeting or make decisions based on expenditure. This business valuation method is widely used in the corporate finance and investment industry.

Precedent Transaction Analysis

In this business valuation method, we compare your company with your competitors in the same industry and the price paid for them. Doing so works as an indicator of your company’s value. In Precedent Transaction Analysis, we can estimate what value your company would have or what the share of stock would be worth. Here, past M&A transactions are studied and used as essential examples to evaluate your company’s value in case of an acquisition.

Comparable Company Analysis

We use Comparable Company Analysis to evaluate your company’s value by comparing it with all the relevant metrics of other companies in the same industry. By studying the analytics and operations of companies of similar size, we can compare them to your company to conduct an in-depth analysis using trading multiples (EV/EBITDA, EV/Revenue, P/B). Calculating any differences and similarities between your company and others can reveal many details.

Why Choose The StartupLab For Business Valuation Services?

At The StartupLab, be assured of getting the best business valuation services; we take every crucial detail into account when we evaluate your business, whether it is any unique detail you provide or every factor we discover. Rest assured that every little piece of data would be accounted for in our valuation services. With years of experience in this field, our talented team of business valuation consultants not only use critical techniques such as DCF Analysis, Precedent Transaction Analysis and Comparable Company Analysis, but they also provide you with data to be used to promote growth for your company. No matter what data we reveal, it will always be your decision what to do with it, whether to take it to greater heights or sell it at the opportune moment. We at The Startuplab promise to stand behind you for it all.

So, if you want to discover your business’s true value and potential, contact us today! Our talented team is eager to help. Check out StartupLab services, a one-stop solution for all your business needs.

FAQ

Q1. What does business valuation mean?

Ans. Business valuation refers to the process of determining the actual economic value of a business.

Q2. Why is business valuation important?

Ans. Conducting business valuation is important for many reasons. It can help you recognise a business’s true worth and allow you to take steps that affect its future.

Q3. Will business valuation services help me in getting potential buyers?

Ans. Yes, by hiring valuation services, you can find the accurate value of your business, allowing you to get potential buyers.

Q4. How long is the business valuation process?

Ans. The amount of time the business valuation process takes is relevant, as it depends on the size of your company and the scope of its industry. However, at The StartupLab, we work to the best of our abilities to give you a proper result at the right time.

Q5. How often should I conduct a business valuation?

Ans. Regularly having your business evaluated every other year is fruitful to check its status and stability in the market.

Q6. What are the business valuation methods you use?

Ans. At The StartupLab, we use three main business valuation methods: DCF Analysis, Precedent Transaction Analysis and Comparable Company Analysis.

Q7. What are the benefits of business valuation?

Ans. An accurate business valuation brings many benefits, such as giving you data to strategise the growth of your business or bringing into light any weakness that it may have in an area.

Q8. Is it worth it for a new company to hire business valuation services?

Ans. Yes, having a professional business valuation for your young business is worth it, as it can give you relevant data that you can utilise to affect its growth positively and find out if it is stable.