Apps In Digital Ledger Segment See Higher Adoption In Small Towns

Due to the availability of cheap data and smartphones, the number of internet users is increasing. As first time users from smaller tier towns and cities come online, tech startups are witnessing an increasing number of users.

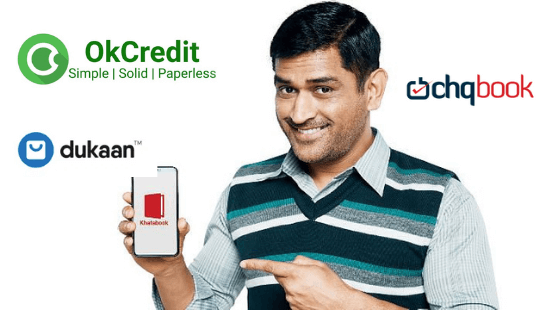

Tech startups in digital ledger space like Khatabook, OkCredit, Dukaan, and Chqbook have also carved out a niche market targeting micro and small merchants.

Many founders and investors in the segment pointed out that after the COVID-19 pandemic struck India, adoption of digital ledger products like Khatabook and OKCredit has been on the rise.

Giving some details about the small merchants, Harsh Pokharna, chief executive of OKCredit, said that small merchants like kiranas or a paan shops lodge a maximum of 100 transactions a day.

Out of these, 30% of the transaction could be made exclusively on credit, including merchant’s loyal or repeat customers.

Harsh Pokharna added,

“As a small store owner, the biggest worry is recovering this money before end of the month, and hence it becomes very important for the merchant to keep a track of these transactions. End of the month, these credit transactions made to repeat customers may very well help the merchant breakeven and make some profits.”

As per industry estimates, there are at least 60 million small and micro-merchants in the country currently.

Need legal assistance for your startup? Just contact us.

Follow us and connect with us on Instagram, Facebook, and LinkedIn.